Prime Family

Prime Coalition is dedicated to supporting scalable solutions that we believe will have a massive impact

on climate change. To fulfill our mission, we create

and run our own nonprofit programs while also

building and supporting a growing family of

organizations that are governed by Prime’s mission.

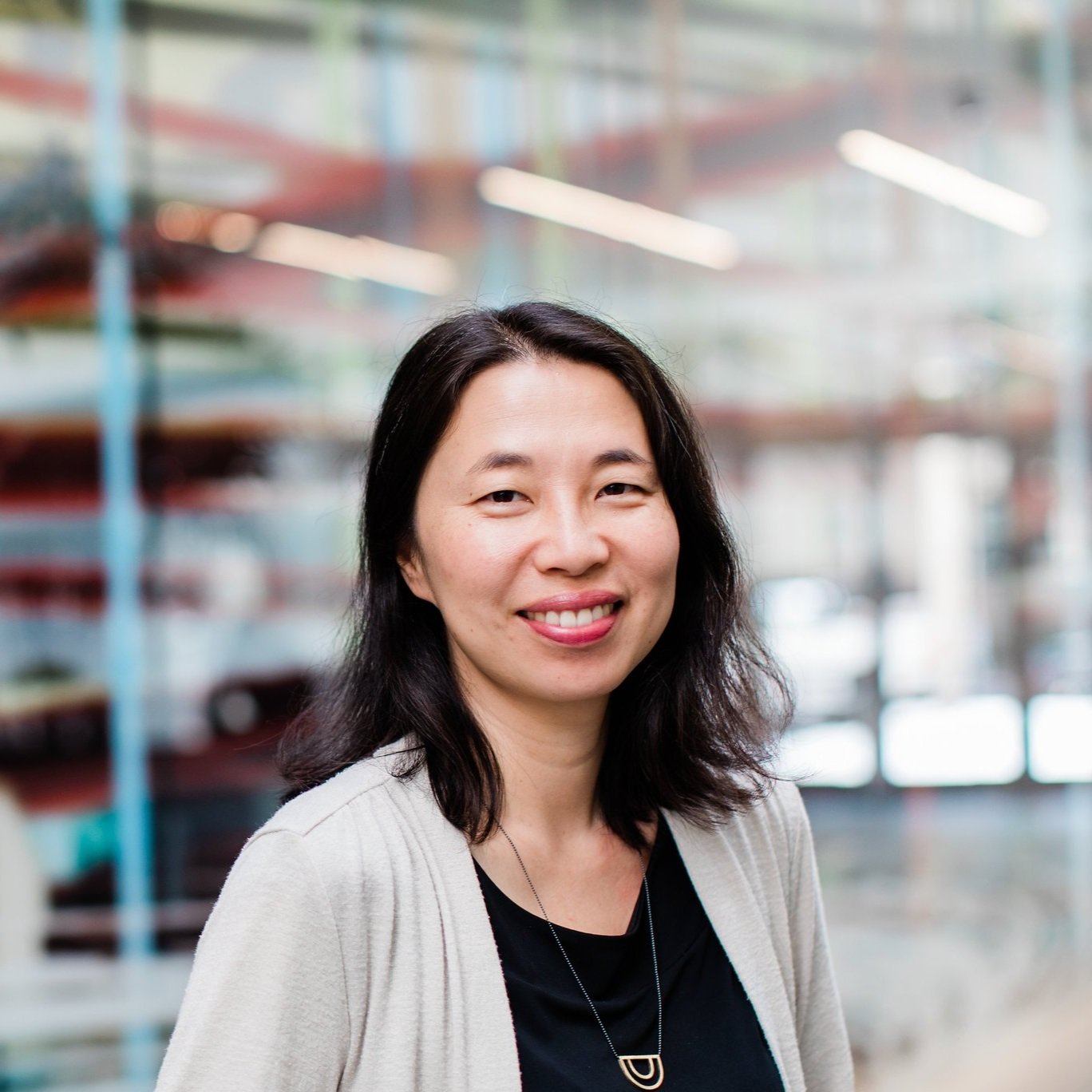

Prime Coalition Staff

Manager, Communications

Senior Executive Assistant

Executive Assistant, Executive Office

Senior Advisor, Impact Accountability

Manager, Executive Office

Chief Program Officer

Senior Associate, Trellis Climate

Founder & Chief Executive Officer

Manager, Partnerships Operations

Assistant Director, Impact

Communications Specialist, Project Frame

Manager, Impact Accountability

Principal, Trellis Climate

Managing Director, Trellis Climate

Senior Associate, Impact

Chief Operating Officer

Assistant Director, Finance

Senior Manager, People & Culture

Manager, Demand Flexibility Project

Principal, Trellis Climate

Assistant Director, Partnerships

Senior Associate, Impact

Manager, Knowledge Sharing

Assistant Director, Impact

Azolla Ventures Team

Head of Finance and Operations

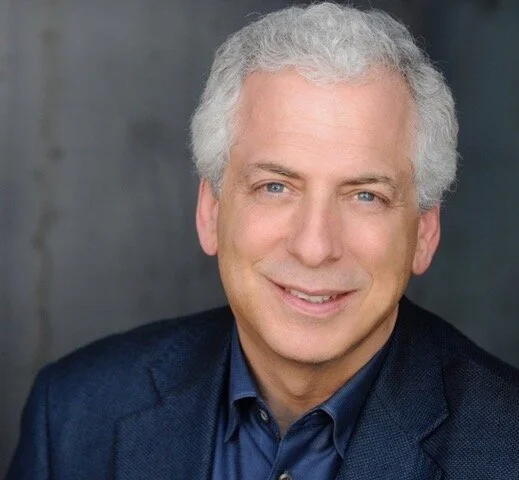

Board of Directors

Outside Board Committee Members

General Atlantic | BeyondNetZero

Cambridge Associates

Mission Alignment Committee

The Mission Alignment Committee (MAC) serves in a cross-cutting advisory capacity to ensure fidelity to Prime's nonprofit mission in the context of all our catalytic investment programming. The MAC reviews Prime’s pre-investment diligence on impact potential and additionality, and is gating to all investment decisions. Post-investment, the MAC holds our nonprofit staff and our affiliated investment managers accountable to Prime’s impact goals through proactive oversight of ongoing impact management and reporting, as well as responsibility over impact-linked compensation when needed.

Investment Advisory Committee

The Investment Advisory Committee (IAC) serves in an advisory capacity to Prime’s venture capital practice, providing point-in-time input on whether each prospective early-stage company 1) is likely or unlikely to secure sufficient financial support from commercial sources of capital, and 2) might become attractive to co- or follow-on commercial investors, once sufficiently de-risked.